Introduction

The Gulf Cooperation Council (GCC) is undergoing rapid digital transformation, fueled by national visions, cloud adoption, and AI, driving significant demand for robust digital infrastructure.

Within that, data centers are experiencing unprecedented growth, establishing the digital foundations for future economies, attracting major players, and significant investment into the region.

In this Expert Insight Series, we sought the expertise of Ramez Dandan, former Regional CTO of Microsoft, who was key in establishing Microsoft’s first Middle East cloud data center region. This piece aims to analyze this growth, understand the drivers, and explore the competitive landscape. Moreover, we combine his expertise with Infoquest’s Expert Network market data and analysis.

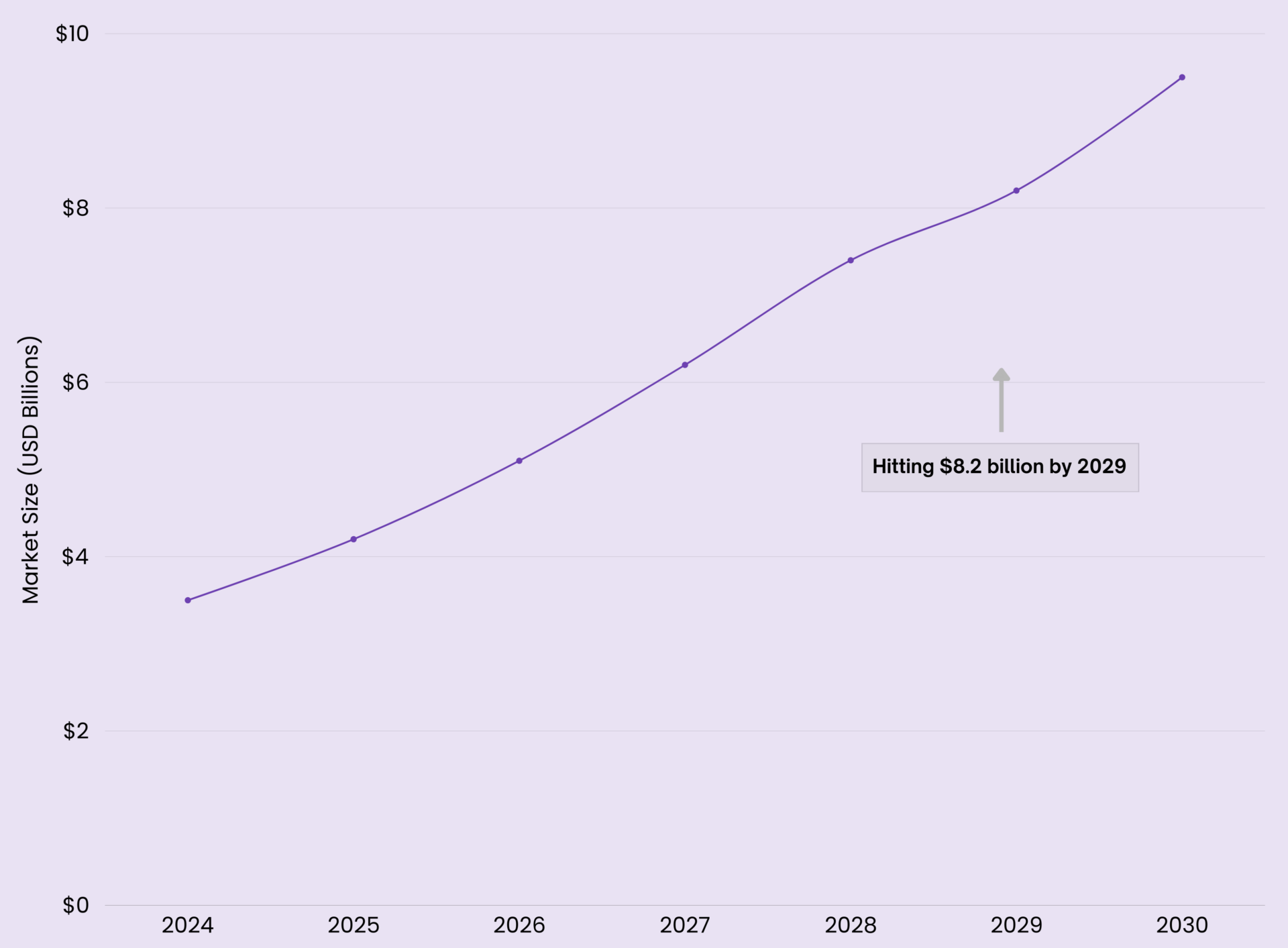

Quantifying the Growth

Reflecting on the market, Ramez Dandan noted, “The data center sector has been seeing very high growth in the last seven years, and it is still today one of the highest growth markets for data centers in the world.”

Unprecedented Growth Rates and Market Value

Dandan provides context: “Between 20% and 27% growth every year, which is amazing, but it’s coming off a very low base, so there’s still a long way to go.” This high CAGR reflects both initial catch-up and significant future potential as digital density increases. IMARC Group anticipates an even higher CAGR of 27.9% for 2025-2033 (IMARC Group GCC Data Center Report), reinforcing the trend of exceptional growth.

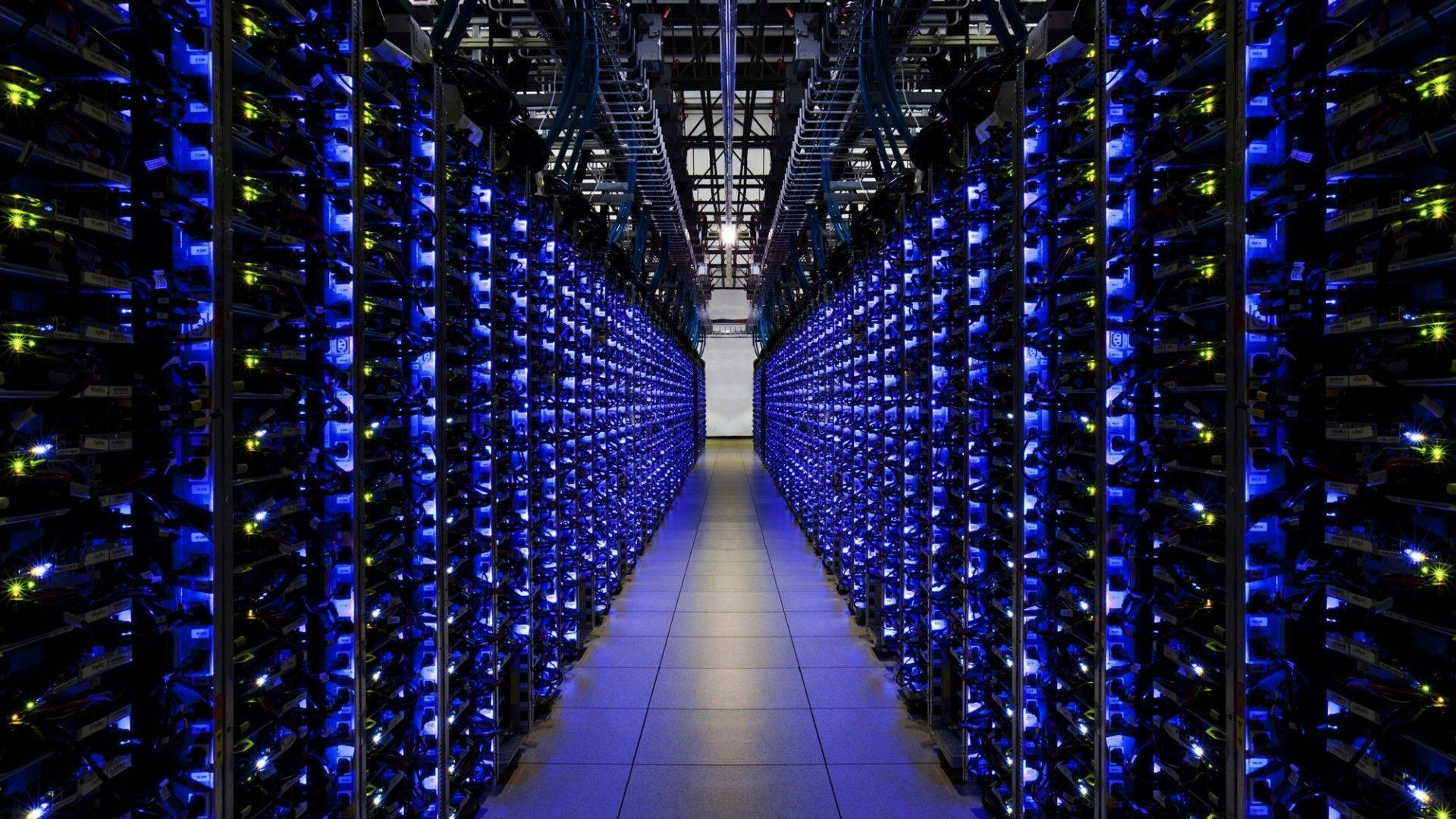

A Surge in Capacity Expansion

Data from Knight Frank / DC Byte (Knight Frank / DC Byte MENA Data Center Report) shows a dramatic increase in both operational and planned data center capacity (MW) after 2020. Estimates suggest roughly 80–90 operational data centers in the GCC as of 2024. The GCC Colocation Existing & Upcoming Data Center Portfolio Report 2024-2028 (MENA Colocation Data Center Portfolio Report).

Saudi Arabia and the UAE are the dominant hubs, accounting for over 75% of the region’s existing data center rack capacity. This concentration reflects their large economies, digital strategies, and investments, attracting major players but also raises considerations about grid stability and market consolidation.

Key Drivers Fueling the Demand Engine

The exponential growth in GCC data centers is driven by several interconnected factors reshaping the region’s digital landscape.

1- The Pull of Cloud Computing Adoption

Cloud adoption is a primary driver. Dandan stated, “Cloud adoption is the single biggest driver of demand for data centers in the GCC. With governments and enterprises embracing cloud-first strategies, global cloud providers like Microsoft, AWS, and Google Cloud have had to establish local cloud regions to meet the growing demand.”

Major cloud providers have established a local presence: Amazon Web Services (AWS) in Bahrain and the UAE; Microsoft Azure in the UAE and Qatar, with a Saudi region under development; Google Cloud Platform (GCP) in Doha, with plans for Saudi Arabia and Kuwait; and Oracle Cloud Infrastructure (OCI) in Jeddah, Dubai, and Abu Dhabi.

These local deployments will play a major role in reducing latency, addressing data sovereignty issues, and enhancing cloud service potential.

2- Digital Transformation and Smart Initiatives

GCC governments are pursuing digital transformation agendas within economic diversification plans like Saudi Vision 2030 and the UAE’s ‘We the UAE 2031’ vision. Dandan affirmed, “Government initiatives like Saudi Vision 2030 and Abu Dhabi’s national strategies are emphasizing technology adoption, and that’s creating massive demand for data centers.”

These initiatives include e-government portals, digital identity programs, smart grids, digitized healthcare, and fintech ecosystems as well as Smart city projects like Saudi Arabia’s NEOM, Dubai’s Metaverse Strategy (Official Strategy Document) and Digital Government Strategy, and Abu Dhabi initiatives rely on local data centers for IoT, city management, AI analytics, and autonomous systems.

3- Regulatory Mandates & Data Sovereignty

Growing emphasis on data sovereignty and privacy is another key driver. Dandan commented, “There is a bigger appetite for sovereign control over data, which is also driving investments in regional data centers.”

Data protection laws like Saudi Arabia’s Personal Data Protection Law (PDPL), the UAE’s Data Protection Law, and similar regulations often restrict cross-border data transfer, encouraging local data processing and storage.

Sector-specific regulations in finance and telecommunications also require local data residency.

Therefore, these policies play a large role in driving demand for local data center capacity.

4- AI & Emerging Workload Catalyst

The rise of AI, ML, big data analytics, and other data-intensive technologies is rapidly increasing data center demand. Businesses and governments are leveraging AI for various applications.

GCC countries are actively promoting AI, with national strategies and investments in R&D in the UAE and Saudi Arabia.

This drives demand for specialized infrastructure for demanding AI workloads.

The $5 billion investment in a net-zero, AI-centric data center campus in NEOM’s Oxagon (1.5 GW capacity powered by renewables) highlights this trend (Net-Zero AI Data Center Project).

The Competitive Arena

The GCC data center market involves global technology leaders, regional telecom operators, and specialized data center firms. Dandan noted, “We’re still on the maturity curve, but we’re moving fast, thanks to the involvement of global players like Microsoft, Amazon, Google, Alibaba, and Oracle.”

Hyperscaler Dominance and Influence

AWS, Microsoft Azure, Google Cloud, and Oracle Cloud have a significant influence with multiple cloud regions across the GCC. They are key tenants for colocation facilities and are building their own infrastructure.

The potential entry or expansion of players like Alibaba Cloud and Huawei Cloud further indicates the region’s appeal.

Regional Telecom Operators and IT Providers

Regional telecom operators are major players:

- STC Group (Saudi Arabia): Through “center3”, STC is a dominant force with large-scale, carrier-neutral facilities.

- Mobily (Saudi Arabia): Operates its own data centers.

- Tonomus (NEOM, Saudi Arabia): Emerging player with the ZeroPoint DC facility.

- Khazna Data Centers (UAE): Largest operator in the UAE, strategically aligned with G42 and e&.

- Du / Etisalat (e&) (UAE): Infrastructure focus appears channeled through partnerships like Khazna.

- Equinix: Global colocation provider with a presence in key hubs like Dubai and Muscat.

- Other Regional Telcos: Batelco (Bahrain), Ooredoo (Qatar and Oman), and Zain (Kuwait) have invested in their national markets.

New Entrants and Investors Injecting Capital

The market attracts new investment, such as:

- Edgnex (DAMAC Group): Building data centers across the Middle East.

- Quantum Switch Tamasuk (QST): Joint venture targeting large-scale campuses for hyperscalers in Saudi Arabia.

- International Colocation Interest: Major players like Digital Realty and NTT Global Data Centers are exploring market entry.

Conclusion: A Maturing Market Poised for Global Prominence

Insights from Ramez Dandan and market data show the GCC data center market has immense potential. Driven by cloud adoption, digital transformation, data sovereignty, and AI, the region is attracting significant investment and building advanced digital infrastructure.

The competitive landscape is evolving with global hyperscalers, strong regional telcos, and specialized developers.

Dandan summarized, “Strategic partnerships, customer-centric design, and investment in AI-driven infrastructure will define the next phase of GCC’s data center evolution.”

By fostering collaboration and focusing on sustainable designs aligned with national ambitions, the GCC is on track to become a vital global data infrastructure hub.

Closing Remarks: Your Expert Partner in Navigating the GCC Data Center Landscape

At Infoquest, we provide localized insights across the Middle East, offering access to industry leaders like Ramez Dandan, alongside market intelligence and analysis.

Whether you are a consulting firm, planning business expansion, or an investor, Infoquest connects you with critical knowledge for informed decisions in the GCC data center market. Leverage expert guidance to fully understand the market dynamics, growth drivers, competition, and investment risks

To unlock the insights you need, reach out to Infoquest today via email at info@iqnetwork.co or connect with us here.