Introduction

In the GCC, water from desalination is becoming as strategically important as oil and gas. Desalination is now crucial for national survival, economic resilience, climate adaptation, and strategic autonomy.

Brian Doucette, former COO of NOMAC (largest private sector potable water producer), told the Infoquest Expert Network, “Desalination in the GCC is undergoing an unprecedented expansion, driven by factors far beyond just basic needs. It’s not just about meeting immediate water demands anymore. It’s fundamentally about building long-term infrastructure resilience and strategically managing the critical water-energy nexus.”

This analysis in our Expert Insights series, with insights from experts like Doucette and external data, argues that desalination is foundational critical infrastructure for the GCC, on par with energy, transport, and housing.

Demand is Soaring: The Desert’s Unquenchable and Growing Thirst

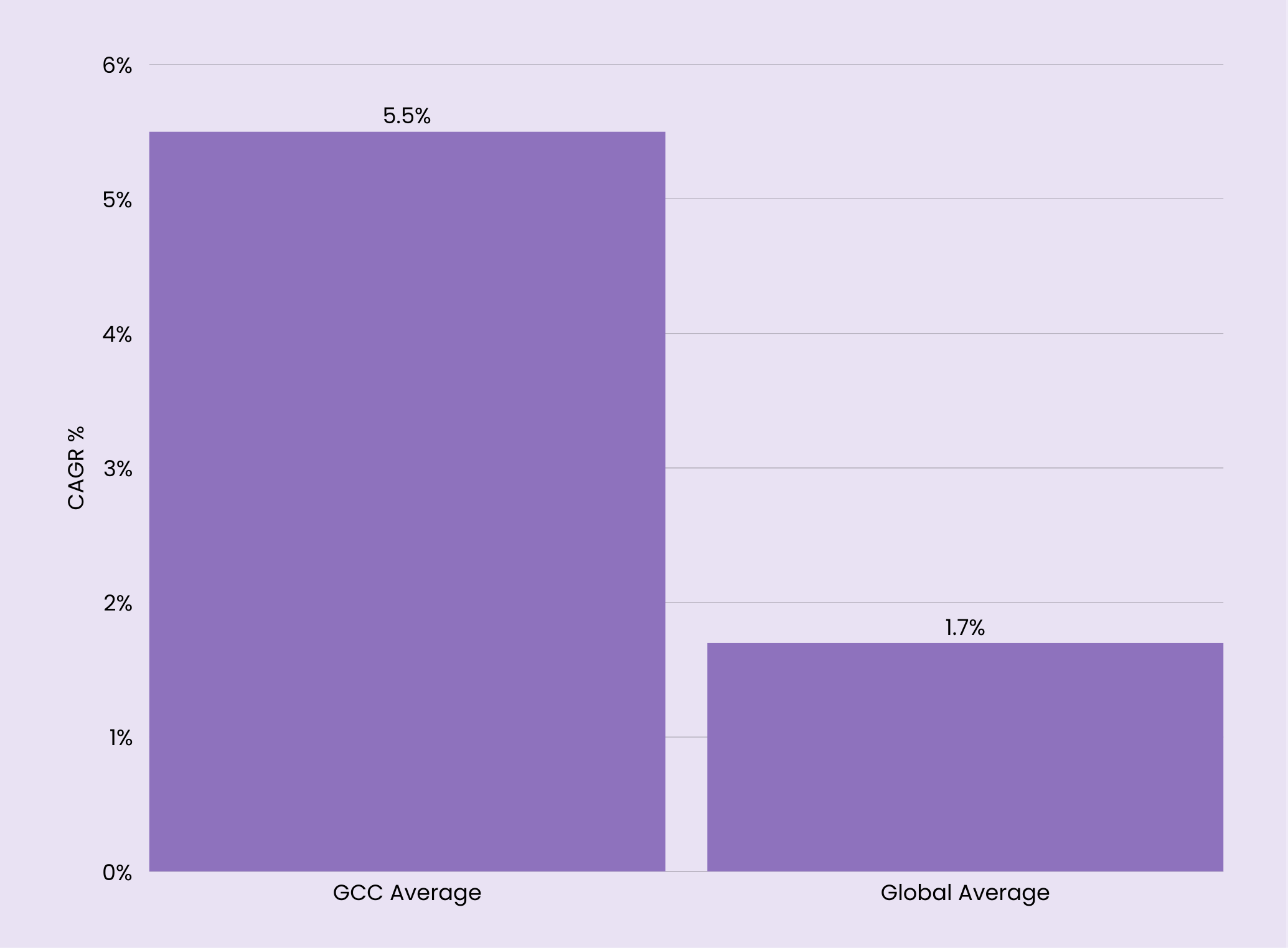

Water demand in the GCC is growing faster (5% to 6% per year) than the global average at 1.7% (World Bank GCC Water Report), due to:

- Rapid Urbanization: Expanding GCC cities increase demand for potable water.

- Aggressive Industrial Diversification: New water-intensive industries (petrochemicals, manufacturing, data centers [see our Data Center Expert Insights Series] require reliable process water.

- Expanding Agriculture and Tourism: Agriculture and tourism development (resorts, golf courses) strain water resources.

- Visionary Megaprojects: Projects like Saudi Arabia’s NEOM and Red Sea Global, and Qatar’s Lusail City require massive desalination capacity.

Doucette emphasizes that this scaling is “fundamentally driven by population growth projections, aggressive industrial diversification plans outlined in national visions, and robust government policies actively promoting infrastructure development through entities like Saudi Water partnership Company (SWPC) or Emirates Water and Electricity Company (EWEC).”

National Visions Cementing Water as a Strategic Priority

Desalination is central to the GCC’s long-term national development strategies:

- Saudi Vision 2030: Targets water security alongside energy diversification, relying on the Saudi Water Partnership Company for new desalination capacity via Public-Private Partnerships (PPPs).

- UAE Water Security Strategy 2036: Aims for sustainable water access by reducing demand, increasing treated wastewater use, and improving desalination efficiency (targeting over 30% energy consumption reduction).

- Qatar National Vision 2030: Emphasizes integrated resource management (water, energy, food) and sustainable development, influencing technology and efficiency targets for projects via Kahramaa.

Doucette advises that these frameworks emphasize the water-energy nexus and favor large-scale PPPs for reliable, efficient infrastructure and regional water autonomy.

Who’s Leading the Charge?

GCC states rely heavily on desalination, but have distinct strategies:

Saudi Arabia: The Unrivaled Scale Leader

Saudi Arabia has the largest desalination capacity (estimated 9.2 million m³/day), driven by SWPC (4th MENA Desalination Report). The Kingdom is rapidly deploying large-scale Reverse Osmosis (RO) plants, replacing older thermal plants, especially along the Red Sea and Gulf coasts.

Projects like the Rabigh 3 IWP (600,000 m³/day) use advanced RO technology procured via PPPs with developers like ACWA Power.

Doucette notes Saudi Arabia’s immense financial resources and SWPC’s sophisticated procurement enable rapid scaling. EPC giants like Larsen & Toubro (L&T) also are building maximum-capacity plants quickly.

United Arab Emirates: The Hub of Innovation and Sustainability

While having less capacity than Saudi Arabia (around 2.1 million m³/day), the UAE, particularly Abu Dhabi, often leads in innovation and sustainability.

The Taweelah IWP, the world’s largest operating RO plant (over 900,000 m³/day), integrates substantial solar power generation, aligning with the UAE’s Net Zero ambitions.

Doucette states that the UAE’s PPP model, through EWEC and entities like TAQA, effectively structures projects that attract global leaders and prioritize efficiency.

Qatar: The Strategic Planner

With lower capacity needs (around 0.9 million m³/day), Qatar focuses on strategic planning and execution.

Historically they have been reliant on efficient thermal desalination co-located with power generation (fueled by LNG), Qatar is now embracing large-scale RO and its stable regulatory environment attracts international developers and investors (Engie, Marubeni, Samsung C&T) for reliable project delivery.

A Foundational Pillar, No Longer Optional

Brian Doucette, via the Infoquest Expert Network, emphasizes the strategic shift:

“Look at the national budgets, the planning cycles, the level of sovereign backing. Desalination is now being planned, funded, and prioritized on par with major energy projects, transportation networks, and housing programs. It’s moved beyond being just a utility service. It’s viewed by leadership across the region as absolutely fundamental for long-term resilience, economic stability, and national autonomy in an increasingly uncertain world.“

His insights highlight that the GCC is strategically investing in desalination for future prosperity.

Conclusion: Water as the New Pillar of Gulf Progress and Resilience

Desalination in the GCC has become central to national strategy, enabling economic diversification, urban growth, climate resilience, and regional stability. Investments in projects like Rabigh 3, Taweelah, and NEOM indicate the GCC’s commitment to mastering desalination technology. Therefore, understanding the GCC’s future requires focusing on both its oil and its water.

For subject matter expert insights into the GCC desalination industry, including water-energy nexus analysis, investment trends, and technology assessment, reach out to info@iqnetwork.co or connect with us here.